Heard on the grapevine: "Value is what a damn fool is ready to pay for it!". Discarding the price element, value is the perceived capacity of a product or service to satisfy a set of needs. New business mindsets and pricing models will have us revisiting this rather basic definition in order to introduce two concepts, namely benefits impact and benefits scope.

Think of the following situation: you are offered a free cinema ticket provided you contribute with all the other spectators to the supply of the necessary energy that will power the infrastructure. You are kindly asked to collectively do some wheeling on bicycles, supplying the watts through electric-pedal power generator, whilst you are watching the latest "Shrek IV" movie. To overcome the whirr of the wheels, you are equipped with the latest hearing sets technology and, presto you are having a "Green Cinema Experience" … for FREE!

Nowadays, the concept of value is bearing so many different meanings that nobody for sure might endeavour to provide a rational definition. Besides the classical usage versus exchange value (explained by the water & the diamond value), we can suggest three perspectives: economic (value to business e.g. expected benefits), marketing (value to customer e.g. perceived value) and managerial (no-value elimination e.g. total quality); each with their own criteria. Of course, ultimately, economic value is determined by every one of us, through the basic laws of supply and demand.

Let us be clear from the start, the managerial perspective will not be discussed here. Quality has become a general expectation; it is no longer a true value-adding feature. Process performance improvement, cost reduction, waste elimination, etc. are benefits that are not necessarily indicative of company value-added.

For the economist, in the heydays of ‘Information Economic’ (see M.M. Parker & R.J. Benson), one could hear in the boardrooms that "Value is based on advantage achieved over the competition, reflected in current and future business performance. That is the value in which management should be willing to invest". Consultants started then talking about the economic value of information, value linking and value acceleration, shying away from the classic cost-benefit analysis (ROI).

What is striking about that definition is the prominence of the competition. The competitors are stirring up the business owner. Translated into the new world we are currently witnessing, few would challenge the above definition. Recently, two business trends have re-shaped our views on value: the emergence of the knowledge business and the relationship economy. That means the strategy is to be more customer-centric rather than market-position centric (see A.J. Slywotzky). The time and place dimensions are also playing a different role in the value equation. Beside desirability; availability at the right time and at the right place is tantamount to added-value, a clear side-effect of the ubiquitous Web.

As a basic example, think about the way Amazon is taking advantage of natural consumer behaviour during their purchasing process. People value the ratings of their friends more than anything else (82% of purchasing decision are based on other’s recommendations). Relationship capital is now to be considered and "value is tallied throughout & beyond lifetime of subjects being measured" (see J.T. Deragon).

From a marketplace perspective, value creation still requires an interaction between a buyer and a seller, but that interaction becomes a possibly-long-lasting conversation rather than an instant exchange. Here we introduce our "benefits impact" concept that is linked to the timeframe of the value creation process.

As far as collective value is concerned, let me quote Nicolas G. Carr: "It would be wise, for companies to think not only of their own strategic interests but of the broader interests of their region and industry. In particular, group of companies may want to work together to make improvements to the IT infrastructure that will benefit them all. Spreading the cost and other risks of IT innovation make sense when the innovation is unlikely to provide any one company with an advantage."

Many talked a lot about shareholder value as being the ultimate goal to be achieved by a business owner. Here, we can say that the stakeholder value is shaping the benefits scope. Ultimately, there could be only one stakeholder, i.e. yourself! But also multiple stakeholders in a collective mindset, eventually leading to the society or our planet earth being considered as well as a value(d) stakeholder.

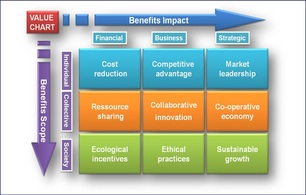

At the expense of simplification, I have listed 9 initiatives that a business might pursue in order to create value. Our "benefits impact" and "benefits scope" make it easy to position those objectives in what I call a value-grid. The first row displays the classic view for assessing value to business but it does not take into account the value perceived by the potential stakeholders.

The second row displays what we are currently experiencing in many domains thanks to the Internet age we have entered into. Co-operative economy is not yet fully embraced but one can start seeing the value of collaborative innovation. Remember our "Green Cinema"?

So, to sum it up, where would you position our "Green Cinema" on that value-grid framework? Depending on your mindset, attitude and emotion, you’ll see the kind of value(d) initiatives that business should start investing in and the different perceived values people are expecting to get.

Last but not least; that value-grid approach can help transforming a business operating in an old-fashioned mindset of the 20th century i.e. a world of consumers (individualism) segmented in utilitarian’s markets (standardization), towards what I called the 21st century eCOzens: communities of ‘prosumers' (co-activism) living in a world of 'conscious diversity' (glocalization).

RSS Feed

RSS Feed